Market & Economic Summary 3Q - 2025

Resilience, Recovery, and the Road Ahead

As we move into the final stretch of 2025, investors have plenty to digest. Markets have bounced back strongly from the spring slump, political headlines like the government shutdown continue to grab attention, and economic data sends a mix of signals – some reassuring, some cautionary. The good news is that stocks have shown resilience, consumers are still spending, and leadership in the market has broadened beyond the biggest tech names. At the same time, valuations are high and policy uncertainty lingers, reminding us that staying disciplined remains just as important as staying optimistic.

Market Overview

- U.S. Equities: The S&P 500 gained 8.1% (on a total return basis, including dividends) in the third quarter, led by technology (+13.2%), communication services (+12.0%), and consumer discretionary (+9.5%). Small caps outperformed large caps in the quarter (+12.4%), while micro caps surged 17.0%.

- International Equities: Developed markets rose 4.8% in the quarter, lagging U.S. markets, while emerging markets advanced 10.9% led by China (+20.8%) and Korea (+12.8%).

- Interest Rates & Fixed Income: Treasury yields declined during the quarter, with the 10-year falling from 4.46% to 4.16%, reflecting softer labor data and Fed policy shifts. The Bloomberg U.S. Aggregate Bond Index rose 2%. Shorter-duration bonds gained modestly.

- Volatility & Dollar: The third quarter was marked by limited volatility as markets drifted upward fairly consistently. The U.S. dollar has fallen about 8% this year, though the decline leveled off in the third quarter.

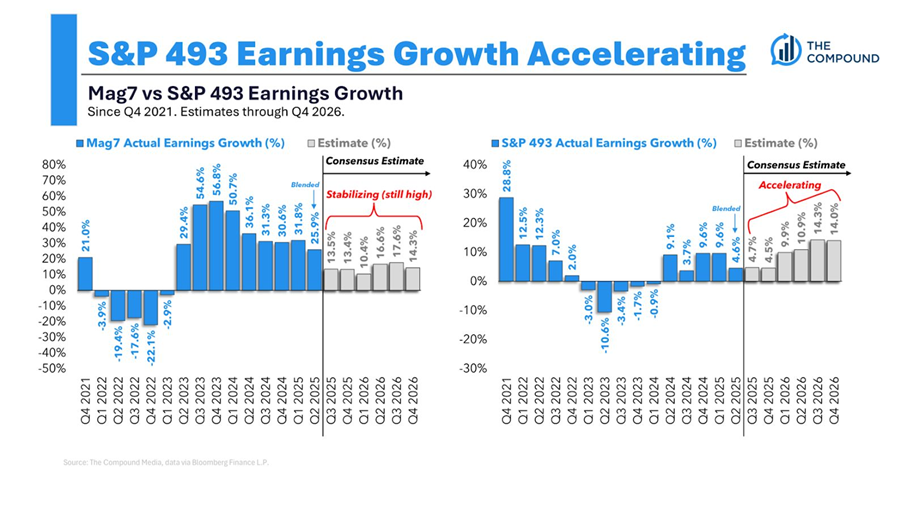

- Earnings & Breadth: S&P 500 operating earnings per share growth is running above its long-term average of 10%, with estimates improving into 2026. Importantly, earnings growth is no longer confined to the mega-cap tech leaders. Broader participation is emerging.

- Valuations: Growth stocks remain somewhat expensive relative to value, with a 44% premium compared to the historical average of 30%. However, some of that valuation premium is attributable to the rapid buildout of AI infrastructure. International equities sit closer to long-term valuation norms, offering a solid opportunity for diversification.

- Commodities: Gold rose 16% in the quarter and is up 46% year-to-date, supported in part by Chinese demand amid property sector stress. Oil prices have normalized into the low $60s per barrel, about half of their 2022 highs.

Economic Backdrop

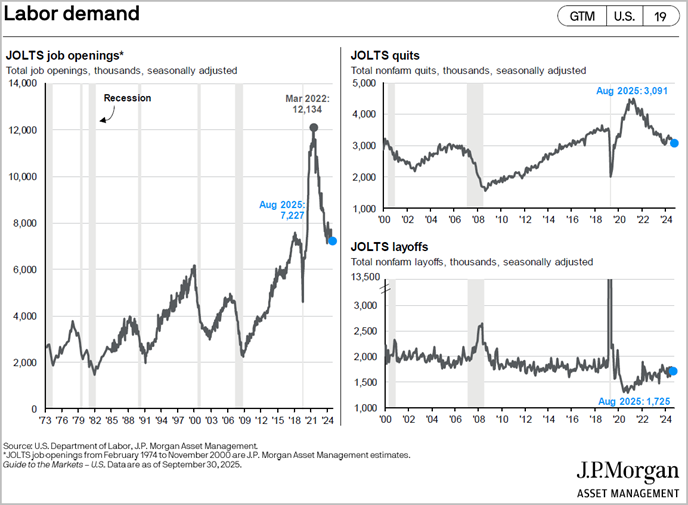

Labor Market: Job gains have slowed, unemployment has ticked higher, and job openings have declined to about 7 million from 12 million post-COVID. Layoffs are rising, quit rates are falling, and participation is slipping again as baby boomers exit the workforce. Overall, the labor market is softening but not collapsing.

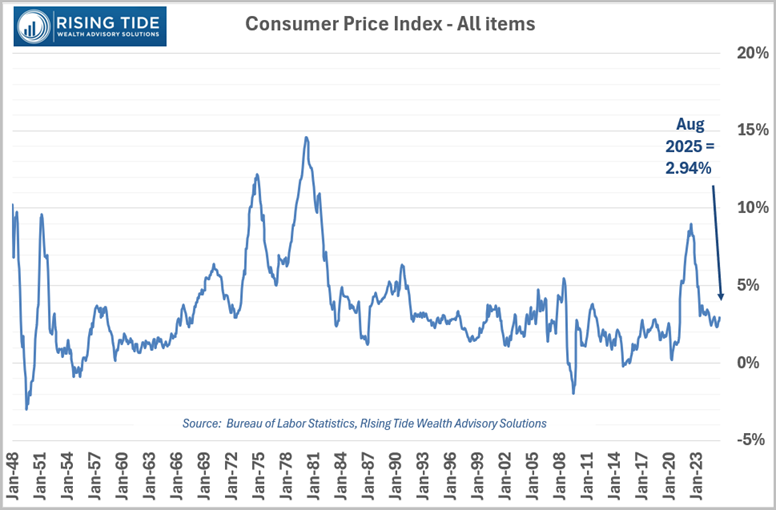

Inflation: Inflation has eased from ~9% highs to around 3%. Housing costs have decelerated, but recent upticks in food, auto repairs, and insurance pushed inflation slightly higher.

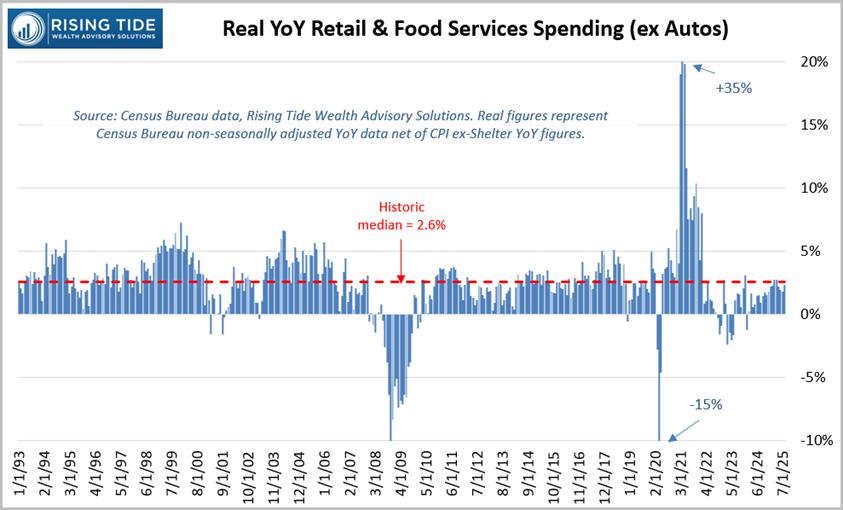

Consumer Spending: Real retail sales growth of ~2.6% matches historical medians, a testament to consumer resilience.

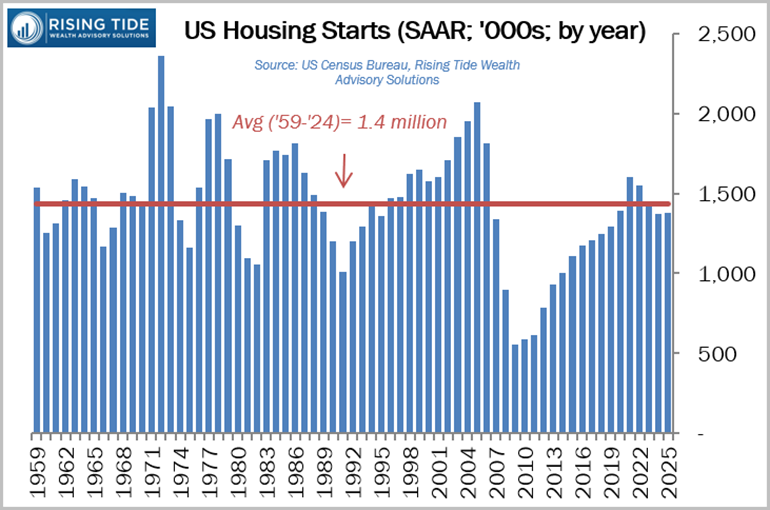

Housing: Housing starts remain below average, constrained by mortgage rates in the 6–7% range. Permits are subdued, though falling rates could eventually spur a recovery.

Key Market Themes

Broadening Leadership. One of the most constructive developments this year has been the expansion of market leadership. For much of the past few years, a handful of mega-cap technology companies – the so-called “Magnificent Seven” – were responsible for the lion’s share of equity gains. In 2025, leadership has widened to include a broader set of sectors and companies, a healthier sign for the durability of the rally. This shift underscores the importance of diversification over concentration in a narrow group of stocks.

The Resilient Consumer. Despite concerns over slowing growth, the U.S. consumer continues to show surprising strength. Real retail spending has improved, providing support for corporate earnings and helping to stave off recession fears. Although the labor market is softening, wage gains and accumulated savings are sustaining consumer activity, keeping the economic expansion on track for now.

Investor Psychology & Staying the Course. Investor sentiment has swung dramatically since the spring. In April, despair was widespread as markets fell into correction territory. By early October, optimism had returned as equities staged a 35% rally off the lows. This is a reminder that the biggest market moves often happen quickly and unexpectedly. Staying invested through turbulence has once again proven more rewarding than trying to time the market.

Valuations & Caution Ahead.

While recent gains have been encouraging, valuations in the US now sit well above long-term averages. The S&P 500 trades around 23 times forward earnings, compared to a 30-year average closer to 17. Elevated valuations don’t predict short-term moves, but they can suggest more modest returns ahead, especially in US large-cap growth. By contrast, small-caps, value stocks, and international markets continue to trade at more attractive levels. For investors with patience and global perspective, these areas present good diversification opportunities.

As we enter the final quarter of 2025, markets sit near all-time highs, powered by resilient consumers, broadening earnings growth, and falling rates. Yet risks remain. Political theater in Washington, Fed policy uncertainty, and global divergences could trigger renewed volatility. But these risks are always there.

The lesson of 2025 so far is that uncertainty cuts both ways: it creates discomfort in the short run, but it also fuels opportunity for disciplined investors. Just as this spring’s downturn gave way to a powerful rally, future bouts of volatility should be seen not as threats but as reminders of why asset allocation, diversification, and long-term perspective matter.

The bottom line? Momentum is strong, but prudence is warranted. Investors who remain balanced and focused on their long-term goals will be best positioned to navigate whatever comes next.