US Stock Market Party Continues Amid Growing Analyst Unease

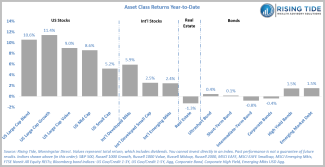

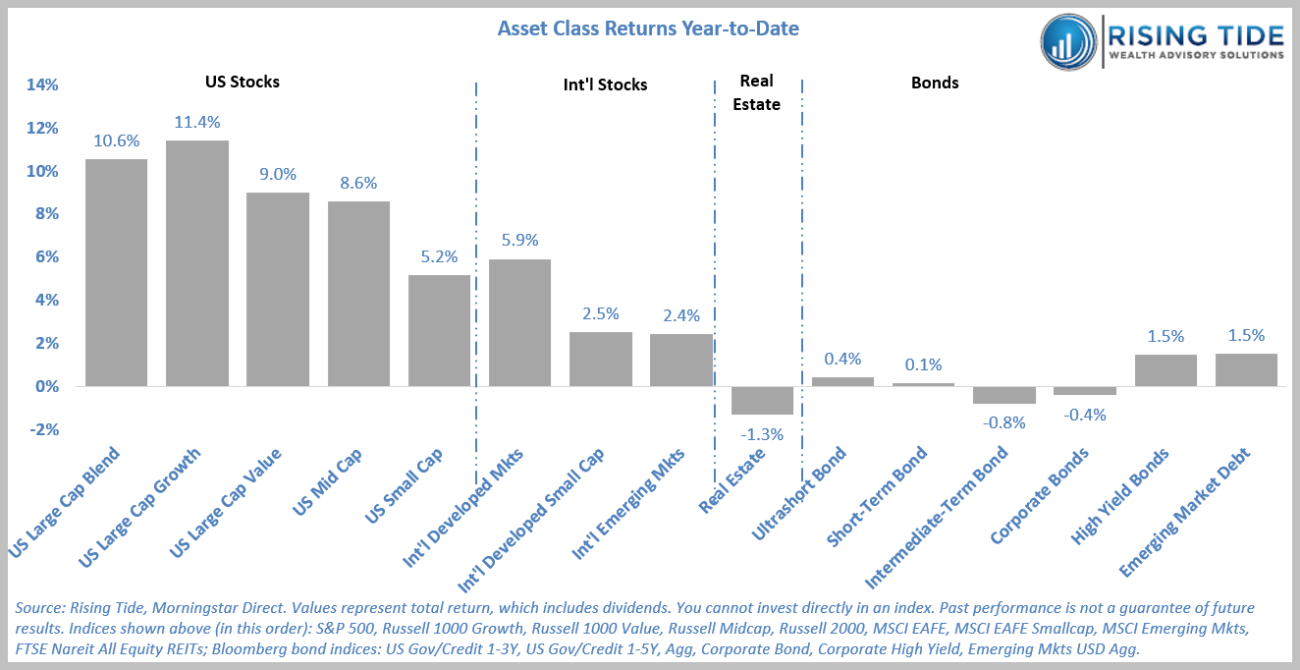

The first quarter of 2024 was quite an impressive quarter for US stocks, with the S&P 500 reporting its 11th best Q1 performance since 1950 (out of 75 observations). On a total return basis (which includes dividends), the index was +10.6%. If the market kept that up for the remaining three quarters, it would put the index on pace to finish the full year 2024 at a whopping +49.4%.

Is the strength witnessed in Q1 likely to continue?

How much of the market growth was earnings growth vs multiple expansion?

Is the overall stock market expensive or cheap, and are there sectors or areas that are less expensive than others?

Has the rally broadened out yet?

What is happening with inflation and the outlook for interest rates?

How do interest rates affect economic cycles?

How do election years affect markets?

All of this, and more is covered in the FULL REPORT: Subscribe now to be the first to get updated research reports and blog posts via email, months before the full report is posted to our website.

Disclosures:

Past performance is no indication of future results. You cannot invest directly in an index. Figures quoted come from Morningstar Direct. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

Rising Tide Wealth Advisory Solutions, LLC (“RTWAS”) is a registered investment advisor offering advisory services in the State of Missouri and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Rising Tide Wealth Advisory Solutions, LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute RTWAS’s judgement as of the date of this communication and are subject to change without notice. RTWAS does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall RTWAS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if RTWAS or a RTWAS authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.