Market Summary 3Q–2023

Winds of Change

Since the Federal Reserve began its rate hiking cycle in early 2022, the US economy has held up remarkably well. The resilience is due to a combination of earlier fiscal stimulus, industrial incentive policies, strong corporate and household balance sheets, and tight labor markets. The persistence of these factors, along with moderating inflation, contributed to a strong first half of 2023 in the US stock market.

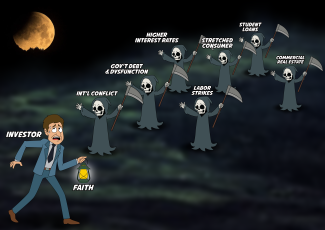

However, just as the leaves begin to change colors and fall from the trees, so too have some of the economic tailwinds that contributed to a great first half. Political appetite for further fiscal spending is waning as rising deficits and higher interest payments continue to push the national debt higher. Consumer balance sheets, while still relatively strong, are beginning to show cracks as ever-higher interest rates (which moved consistently upward throughout Q3) eat into discretionary spending, consumer savings are spent down, and credit card and auto loan delinquencies rise. A recent lift in oil prices and the resumption of federal student loan payments in October (after a 3.5-year pause) may also infringe on consumers’ paychecks, impairing future spending on goods and services.

Meanwhile, mortgage rates continue to move higher, with the national average 30-year fixed rate near 7.5%1 – a figure we haven’t seen since 2000, according to Freddie Mac. This may have consequences for the US labor market, as homeowners are reluctant to sell their homes with low 2-3% mortgage rates and buy new ones with 7.5% interest rates. This may keep the labor market tighter and wage inflation more persistent than usual. Furthermore, in a post-pandemic world where supply chain challenges have contributed to inflation, labor strikes could once again strain supply chains in an already constrained labor market.

Add to those issues the fears about commercial real estate and the growing uncertainty in geopolitical situations such as Russia/Ukraine, China/Taiwan, and Israel/Hamas. Moreover, the postponement of the US government shutdown until mid-November adds to the long list of investor worries. While this lengthy list does suggest the possibility of an economic slowdown, it's crucial to keep in mind that it's not inevitable.

The pessimistic sentiment sent stocks lower in the third quarter, with US large cap stocks2 -3.3% and US small cap stocks3 -5.1%. International markets didn’t fare much better, as developed markets4 were -4.0% and emerging markets5 -2.8% for the quarter. Unfortunately, since interest rates rose aggressively during the quarter (the 10-year US Treasury yield rose from 3.81% to 4.59%), bonds6 didn’t help the portfolio, returning -3.2% (recall that as interest rates rise, bond values fall). Thankfully, investors who held alternatives saw them outperform bonds again.

Despite all the pessimism, it’s important to keep markets in perspective. We’ve been here before. Consumer credit was much worse prior to the 2008 Great Financial Crisis. Interest rates have been much higher. Oil prices have also been higher, but these days the US is the largest oil producer in the world. Geopolitical tensions were commonplace prior to the fall of the Soviet Union. Sure, nobody wants to go back and relive those days, but the point is we have emerged from worse situations in the past.

Moreover, the largest driver of market direction and volatility over the past two years, inflation (and by association, interest rate movements), appears to be trending lower. As additional pressures on consumer spending mount, the demand for goods and services diminishes, naturally allowing prices to drift lower. That’s what the Fed was trying to do all along by raising interest rates (“demand destruction”). In a somewhat paradoxical manner, this is a positive development, indicating that the Federal Reserve is likely approaching or has reached the peak of its interest rate hike cycle (a viewpoint supported by recent statements from Fed officials), which will help lift the shroud of fog surrounding hawkish monetary policy, and help pave the way for a more stable bull market.

Lastly, it’s worth noting that long-term returns by the stock market are driven by corporate earnings growth. From that perspective, analysts are still estimating strong earnings from the S&P 5007 going forward (+11.3% year-over-year for the next four quarters compared to +1.5% for the last four quarters). Long-term investors should remember that economic downturns are an inevitable part of the financial journey, but attempting to precisely time the beginning and end of a downturn is exceedingly challenging and can have adverse effects on your investments. Those who anticipated a double-dip recession post-2008 often missed out on the subsequent 12-year market upswing. The most prudent approach to prepare for a potential recession is not to liquidate all holdings and hoard cash but to ensure a well-diversified portfolio. To that end, avoid overinvesting in the most expensive stocks, because they have the furthest to fall, and be ready to rebalance and tax loss harvest where appropriate, as these actions can add real value to your overall financial outcomes over time. If you need help, reach out. Rising Tide collaborates with a diverse range of advisors and investors, offering multifaceted portfolio assessments to fortify your ability to withstand economic fluctuations.