Market Summary: 4Q-2022

Beyond the Bumps: Focusing on the Destination

The year 2022 contained many interesting events that had markets bumping around. In geopolitics, Russia’s invasion of Ukraine put the world in fear of World War III and saw the “weaponization” of financial and energy resources. This contributed to global inflationary pressures and started a new cold war, with countries across the world choosing sides. In the world of Western politics, we saw tightly-contested mid-term elections in the US, a revolving door featuring three different UK Prime Ministers, and the death of the Queen of England. In the world of cryptocurrencies, the nearly two-thirds loss in the value of Bitcoin caused several crypto-related companies to declare bankruptcy and resulted in the arrest of Sam Bankman-Fried (the founder and CEO for one of the largest cryptocurrency exchanges in the world) for fraud. To say it was an “eventful” year would be an understatement.

While many of those themes contributed to market volatility, none was a larger detractor from global market performance in 2022 than the dramatic shift in central bank policies. In 2020 and 2021, following many months of global lockdowns, fiscal and monetary stimulus accelerated both economic activity and corporate profits. But, as a portion of workers around the world either 1) transferred into different industries, 2) elected not to return to work, or 3) weren’t able to return to work (as in the case of China and some other countries), supply chains became congested with the inability of fewer workers to service the increased demand. In economics, the natural outcome of a combination of higher demand and lower supply is higher prices (i.e. inflation).

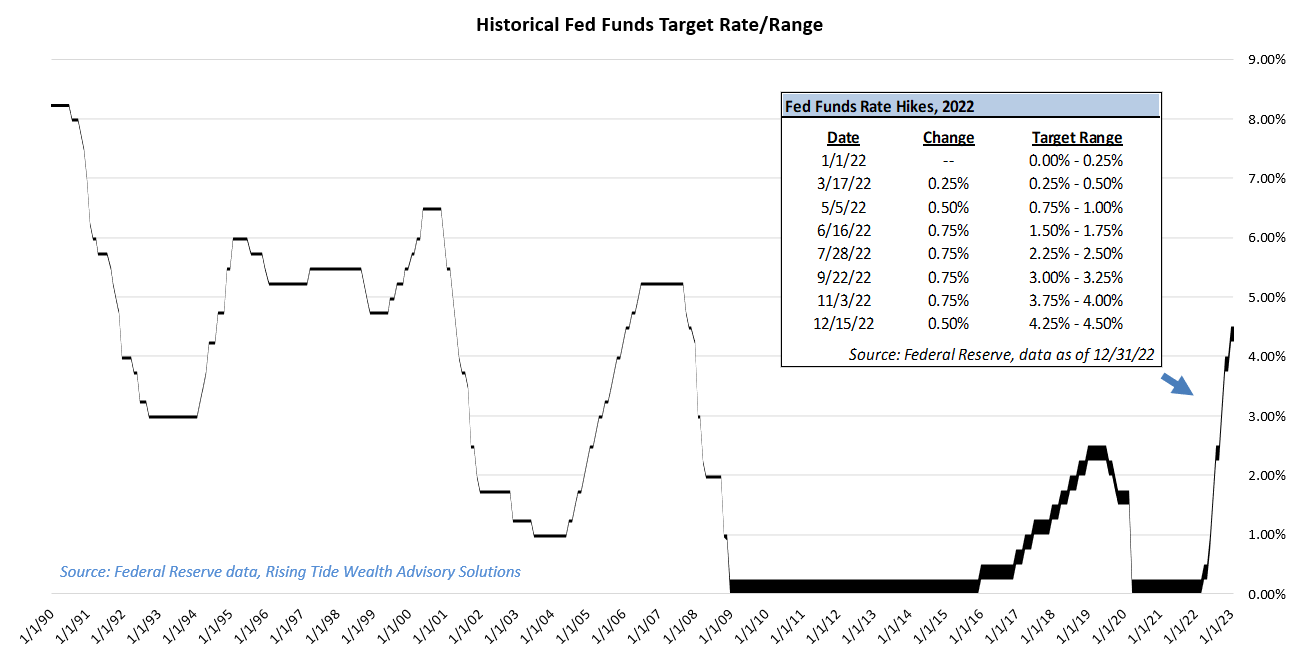

For a while, economists thought the inflation would reverse once supply chains returned to normal. But the persistent dislocation of workers caused inflation to worsen. In late 2021, as the headline CPI (Consumer Price Index) inflation figure rose to 7.0% year-over-year (with core inflation, which excludes the more volatile food & energy components, at 5.4%), the Federal Reserve decided it could no longer wait for things to fix themselves – they needed to take action to slow the consumer demand side of the equation. So, in early 2022 they began to foreshadow (and then later execute on) a series of the most aggressive interest rate hikes in US history. At the beginning of 2022, the Federal Funds Rate target was 0.00%-0.25%, but after seven rate hikes throughout the year, the target range ended at 4.25%-4.50% (see chart below).

When central banks raise interest rates, there is usually one primary intent: to cool off activity in the economy (aka “demand destruction”). It does this by raising the overall cost of borrowing money (the interest rate) for businesses and consumers, which in turn slows spending. This has become most evident in the housing market, where according to Freddie Mac, the average US 30-year fixed rate mortgage started the year at 3.11%, peaked at 7.08%, and ending the year at 6.42%. At the beginning of the year, housing demand far exceeded supply. There were stories everywhere of multiple bidders on each house for sale, with transactions usually occurring much higher than asking price. However, fast-forwarding to the end of the year, the National Association of Realtors recently announced pending home sales in November had dropped to 37.8% lower than year-ago levels. Naturally, a slowdown in homebuying activity has ripple effects for construction activity, labor markets, and retail sales activity - illustrating how the economy is connected to monetary (i.e. central bank) policy.

In the end, higher interest rates appear to have helped moderate the pace of inflation. Headline CPI rose as high as 9.0% YoY in June, but has since dropped to 7.0% as of the most recent reading in November. Core CPI, however, has remained relatively more “sticky”, peaking at 6.7% YoY in September, but falling modestly to 6.0% as of November. Economists believe further rate hikes, as well as the lagged effects of the hikes already in place, should help continue to drive those inflation numbers lower in the future.

So, how did the markets react to the shift in monetary policy? Among US stock markets, the S&P 500 (a measure of the market value of the largest companies in the US) bottomed on October 12th (-24.0% since the beginning of the year), but still finished the year -18.1% on a total return (including dividends paid) basis, while the NASDAQ Composite Index (which contains a heavier weighting to technology stocks) ended -32.5%, and the Russell 2000 (measuring the smaller companies in the US) was -20.4%. The theme of tech stock underperformance was even more pronounced when viewed in terms of “growth” stocks versus “value” stocks. Growth stocks (represented by the Russell 1000 Growth Index) finished the year -29.1%, while value stocks (represented by the Russell 1000 Value Index) were -7.5%. Furthermore, some of the widest-held and best-performing tech companies in the US over recent years were even worse off than the growth index for the year. Tesla (ticker: TSLA) was -65.0%, Meta (formerly known as Facebook; ticker: META) finished -64.2%, Netflix (ticker: NFLX) ended -51.1%, NVIDIA (ticker: NVDA) closed -50.3%, Amazon.com (Ticker: AMZN) was -49.6%, and Alphabet (formerly known as Google; ticker: GOOGL) ended -38.7%.

Foreign stocks didn’t fare much better than those in the US, with the MSCI EAFE Index (representing large developed market foreign companies) -14.5% and the MSCI Emerging Markets Index -20.1%. For most of the year, the US dollar rose significantly, contributing to international market underperformance relative to the US. At one point in late September, it was trading 23.3% higher than the lows from June 2021. However, as the market began to sense that the Federal Reserve was nearing the peak of its hawkish stance on interest rate hikes, the dollar strength began to fade, causing international markets (in US dollar terms) to outperform the US market in the fourth quarter.

Unfortunately, bonds didn’t do much to help an investor’s portfolio in 2022, leading to one of the worst years in history for a “diversified” portfolio (one containing both stocks and bonds). The Bloomberg US Aggregate Bond Index was -13.0% for the year, largely attributable to the rise in interest rates since the beginning of the year (when interest rates rise, bond values decline). As the Fed raised the overnight lending rate by 425 basis points (bps), the 2-year Treasury bond rose by 368 bps (to 4.41%) and the 10-year Treasury bond rose by only 236 bps (to 3.88%). The more muted reaction in longer-dated rates resulted in a yield curve inversion – often viewed as a harbinger of a recession on the horizon.

With the disappointing performance of nearly all market-related investments throughout the year, it’s understandable that investors might exit 2022 with a sour mood. However, lest an investor approach the new year feeling helpless, too, there are a few reasons to be optimistic:

-

If we do tip into recession, it might be the most expected recession in history. A December survey of 38 economists by Bloomberg placed the odds of recession within the next year at 70%. If everyone anticipates a slowdown is coming, businesses and consumers will likely have taken actions to preserve their resources to weather a storm, helping to mitigate the amount of damage that can be wrought during any downturn.

-

With interest rates higher now than they’ve been for nearly a decade, investors can finally make money in fixed income again.

-

Falling stock prices are good for long-term investors. Every incremental dollar invested during periods of distress end up compounding at higher rates when markets eventually recover.

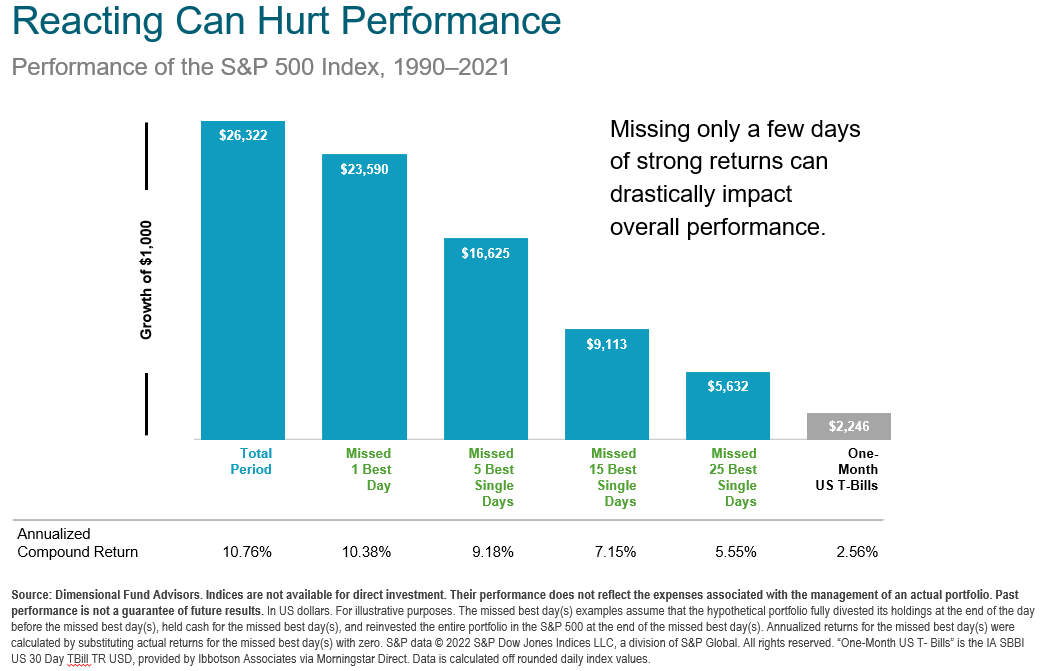

All of that said, we know that the market could very well continue to be volatile in the coming year – but with volatility comes opportunity. It’s important to remember that equities represent one of the riskiest asset classes, and investors expect to earn a higher return (i.e. risk premium) for taking on higher risk. But to earn that risk premium investors must endure the volatility that comes with it and stay disciplined. Data shows (see chart below) that if you miss the best days in the market (which usually cluster near the very bottom, right after heavy down days when fear is at its highest), you may miss a sizable portion of the returns in the market.

Lastly, it's also important to remember that there are tools many investors can take advantage of in downturns that aren’t as prevalent during bull markets. These tactics, such as tax loss harvesting where appropriate and rebalancing, can enhance your overall financial condition and position a portfolio to rebound faster than it would otherwise. If you or a friend or loved one doesn’t have a financial advisor, reach out. We work with several great advisors and we’d be happy to make an introduction or a recommendation. We remind investors that with a new year comes new opportunities. Don’t let a bad year get you down and abandon your plans. It’s never easy to tell where markets are heading – anything can pop up and change the narrative in either a positive or negative way. The road ahead may continue to be bumpy, but stay the course. It should pay off in the end.

--------------------------------------------------------------------------------------------------------------------------------------------

Disclosures:

bps = basis points; 100 bps = 1%

You cannot invest directly in an index. Past performance is not a guarantee of future results. All return figures quoted above are total returns, which include dividends. All information reflected above is from sources we believe to be reliable, although actual information may differ.