Market Summary 4Q–2023

New Year: Fitter, Happier, More Productive

"It's a new dawn, it's a new day, it's a new life for me, and I'm feeling good." - "Feeling Good" by Nina Simone (1965) (and later covered by Michael Buble (2005))

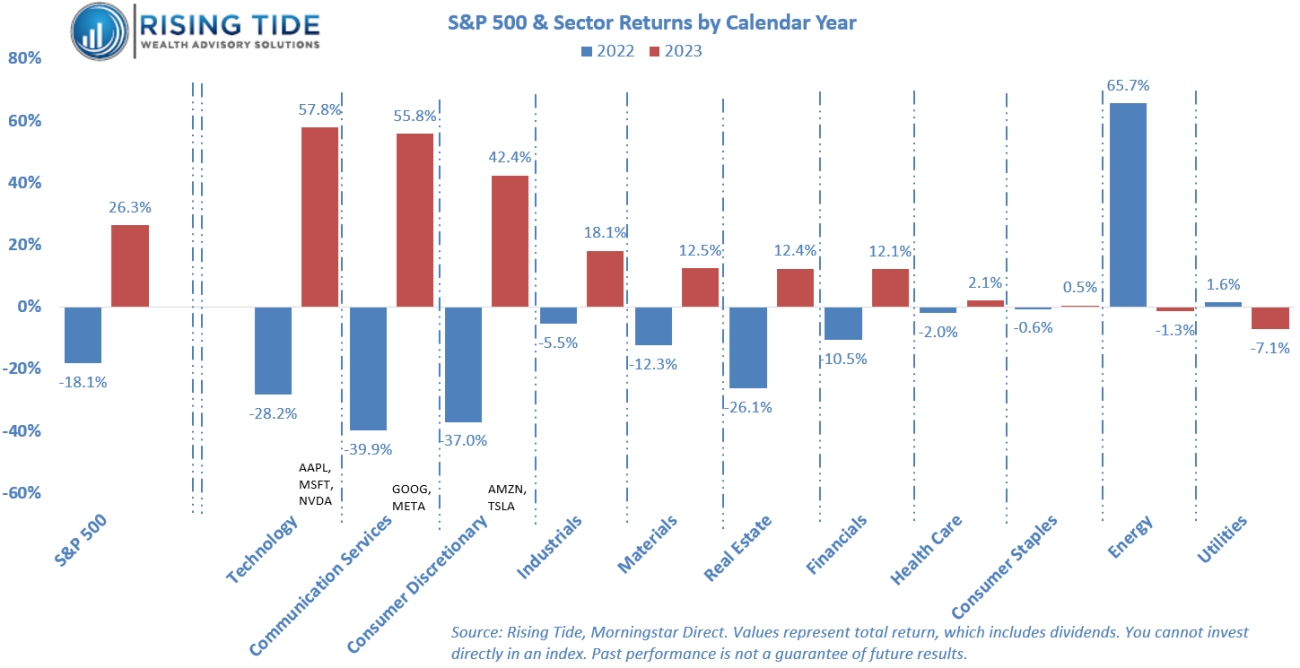

As we turn the calendar to a new year, individuals tend to embrace the idea of new beginnings and prosperity. To that end, a reflection on the financial landscape of 2023 reveals a promising narrative for investors, offering a welcome contrast to the challenges endured in 2022 when both stocks and bonds were down. Large-cap US stocks1 rebounded impressively, finishing the year with a total return (including dividends) of +26.3%, a stark contrast to the -18.1% downturn in 2022. The chart below highlights how the sectors housing the so-called "Magnificent Seven" stocks not only stood out from the broader market, but also drove it higher.

However, a pertinent question arises: can the outstanding performance of the Mag-7 be sustained? While some of its strength is attributed to robust earnings, a portion can be linked to a rebound from the challenging year of 2022. Examining the historical top 10 stocks in the S&P 500 (image below) highlights the notion that companies rarely maintain a permanent position at the top.

Assessing the US market from a valuation perspective reveals a degree of richness, particularly in large-cap growth. JPMorgan Asset Management2 reports that the S&P 500 now trades at 19.5x forward earnings, exceeding the long-term average of 16.6x. In general, foreign stocks continue to trade at significant discounts versus US stocks, presenting an attractive portfolio diversifier.

In the bond market, after two years of negative performance, bonds3 contributed positive returns in 2023. Risk-mitigating alternatives4, especially crucial for stabilizing portfolios in volatile bond markets, generally posted mid-to-high single-digit gains.

Despite lingering uncertainties, the new year brings a fresh start. Positive developments, like lower gasoline prices, resolved labor strikes, and manageable student loan repayments, have alleviated some concerns. Moreover, the decreasing trend in inflation, a major market driver in recent years, has Federal Reserve officials anticipating interest rate reductions in 2024, removing a significant headwind and fostering a more stable framework for a bull market.

For long-term investors, it’s essential to acknowledge that volatility is inevitable and it’s impossible to perfectly time the market. Successful navigation of periodic instability involves establishing strategies for both the anticipation (proper diversification) and the response (tax loss harvesting, tactical trading, and rebalancing). If assistance is needed, don’t hesitate to reach out. Rising Tide is committed to supporting advisors and investors and offering comprehensive portfolio assessments to navigate through turbulent times.