US Stock Market Party Continues Amid Growing Analyst Unease

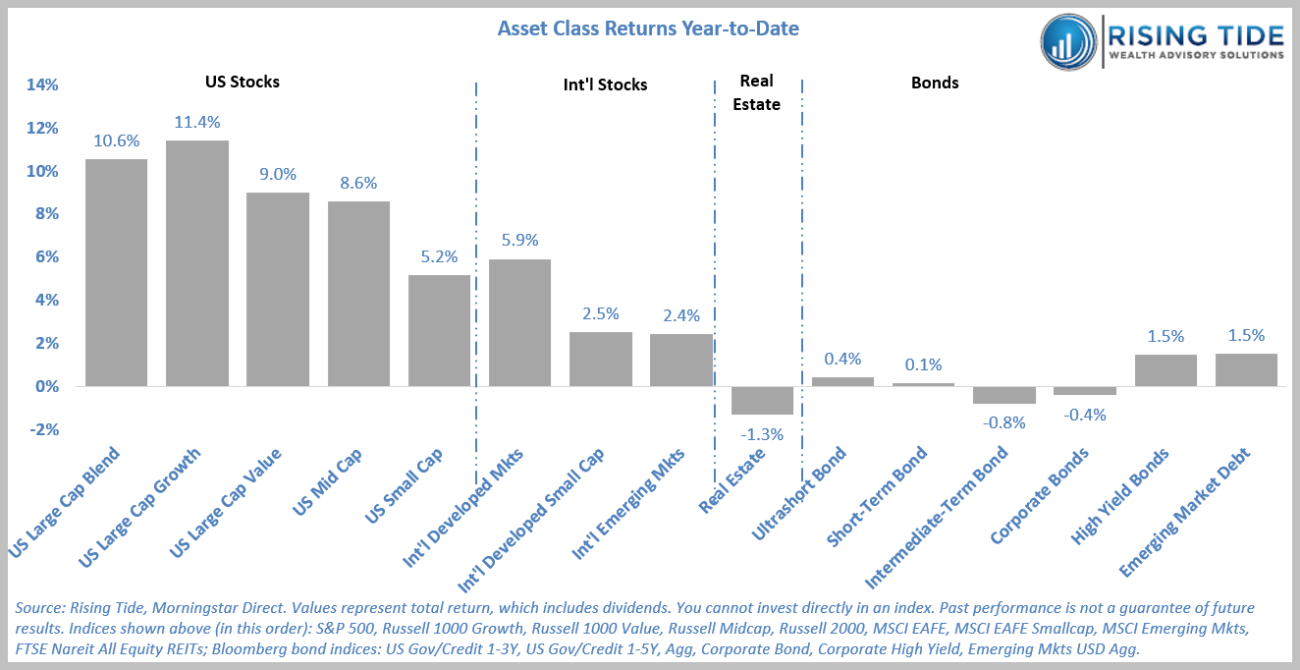

The first quarter of 2024 was quite an impressive quarter for US stocks, with the S&P 500 reporting its 11th best Q1 performance since 1950 (out of 75 observations). On a total return basis (which includes dividends), the index was +10.6%. If the market kept that up for the remaining three quarters, it would put the index on pace to finish the full year 2024 at a whopping +49.4%. But, as much as we'd like to think that's possible (which it is; just not probable), it's more likely we will experience some turbulence at some point along the way. In fact, the median intra-year pullback since 1980 is a decline of roughly 11% from the high.

While some investors celebrate reaching all-time highs after a two-year hiatus, others express concern that the market's rapid ascent might indicate overvaluation. There may be some merit to that, given that earnings growth has slowed a bit lately, meaning most of the gain has been attributable to valuation expansion. According to JP Morgan Asset Management (see chart below), the S&P 500 now trades at a P/E multiple of 21x next year's earnings, notably higher than the 30-year average of 16.6x, largely due to the increased dominance of mega cap growth stocks with elevated multiples.

Much of the valuation expansion has occurred based on the notion that the Fed is feeling better about the trajectory of inflation and is becoming more comfortable with the notion they can lower rates later this year without stoking further inflation. If this happens, it should alleviate some obstacles to corporate earnings growth, fostering a conducive environment for stocks.

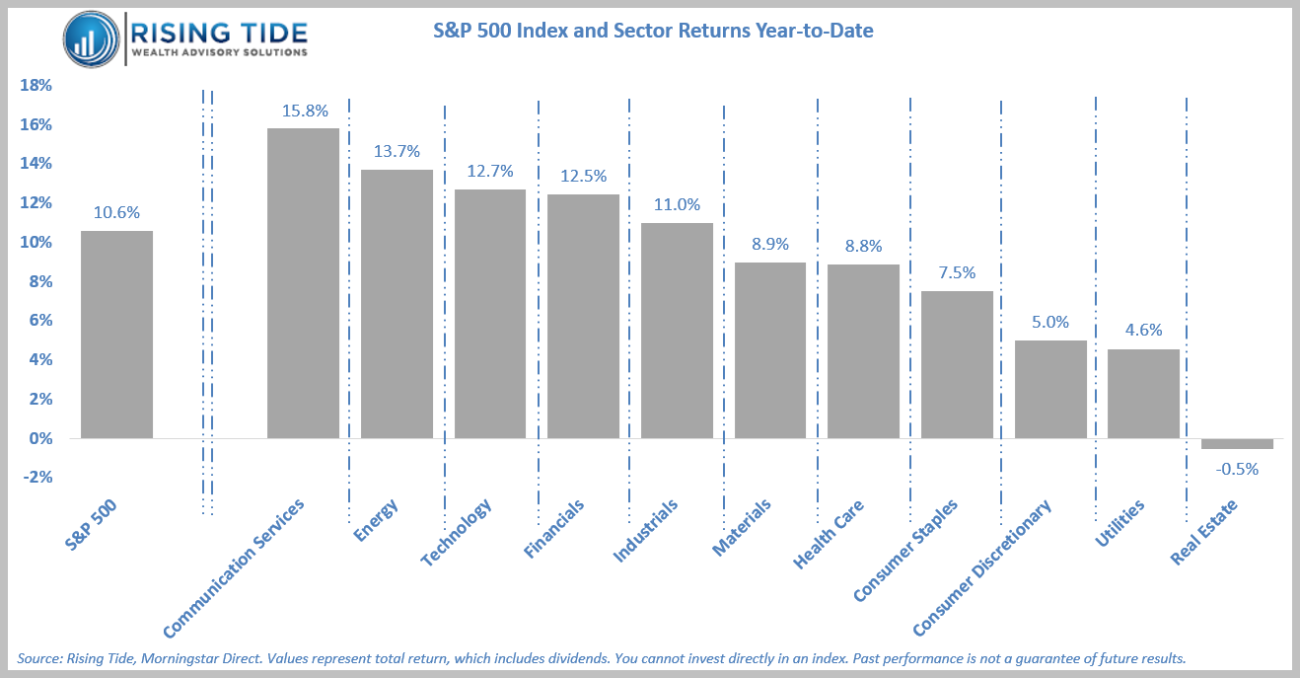

Encouragingly, the US market rally appears to be diversifying beyond large-cap growth stocks, with sectors like energy, utilities, and materials outperforming tech, signaling broadening market breadth late in the quarter (see chart below).

In general, foreign stocks continue to trade at significant discounts versus US stocks, presenting an attractive portfolio diversifier, albeit one which is still in need of a catalyst. In the bond market, interest rates at the front end of the curve stayed steady during the quarter, while those at longer terms moved higher. Because rising rates lead to lower bond prices, longer-duration bonds fell in value. As a result, risk-mitigating alternatives once again demonstrated their importance in stabilizing portfolios amid bond market volatility.

As we approach the halfway mark of an election year, we acknowledge investors may get nervous about who ultimately wins the White House for the next four years. The good news is that we’ve already seen both contenders there before, so while there will likely be some new policies, we’re not really dealing with a complete unknown. Furthermore, research has shown election outcomes have very little impact on market performance (see chart below).

On the economic front, decelerating inflation figures support lower interest rates, which in turn spurs growth for rate-sensitive businesses like banks, residential construction, and industrial manufacturers who benefit from greater capex spending. Nevertheless, the landscape remains susceptible to negative economic shocks, geopolitical tensions, and credit risks.

Nobody knows what the future holds in terms of the economy and the markets, but it’s important to remember episodes of volatility are nothing out of the ordinary. It’s how an investor chooses to deal with those periods which determines whether they will be better off or worse off afterwards. We suggest mental preparation for such episodes by “deciding in the light what you will do in the dark”. Best practice includes taking stock of the tools in your toolbox and the actions at your disposal. If you need help identifying any of those pieces or crafting your playbook, let’s connect. Rising Tide is committed to supporting advisors and investors and offering comprehensive portfolio assessments to navigate through turbulent times before they happen.