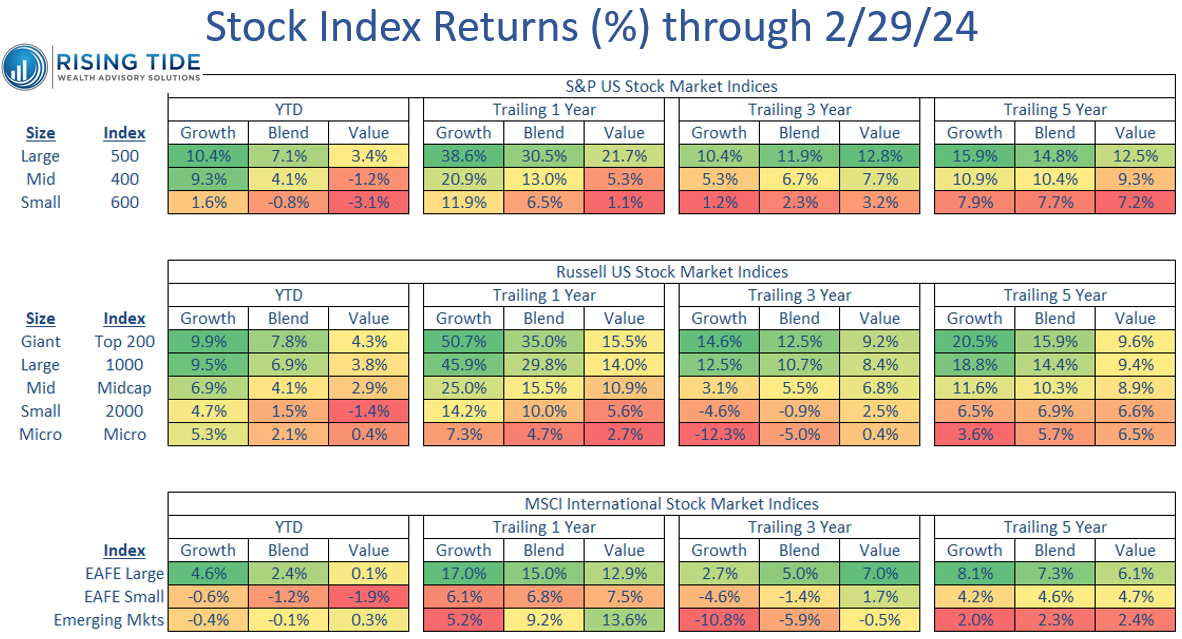

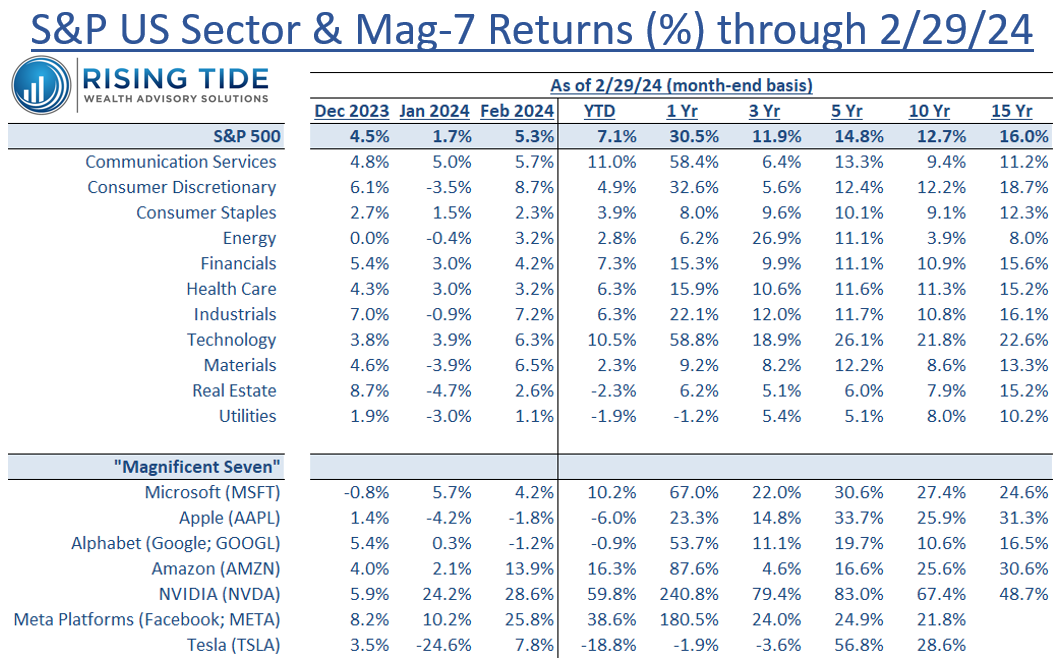

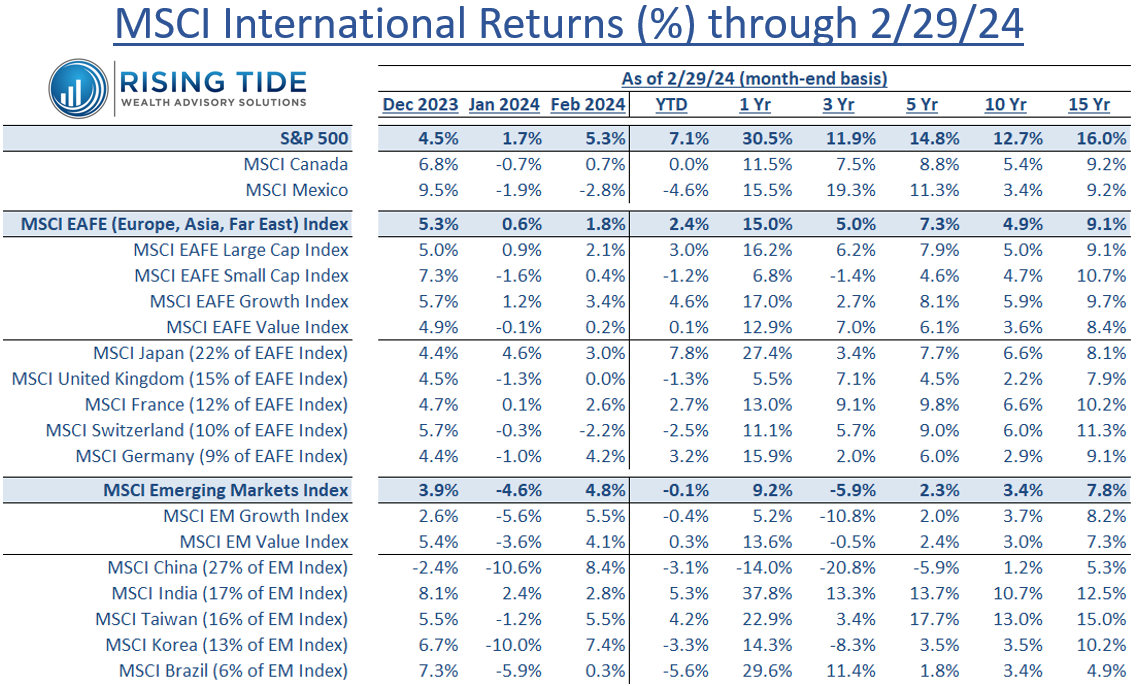

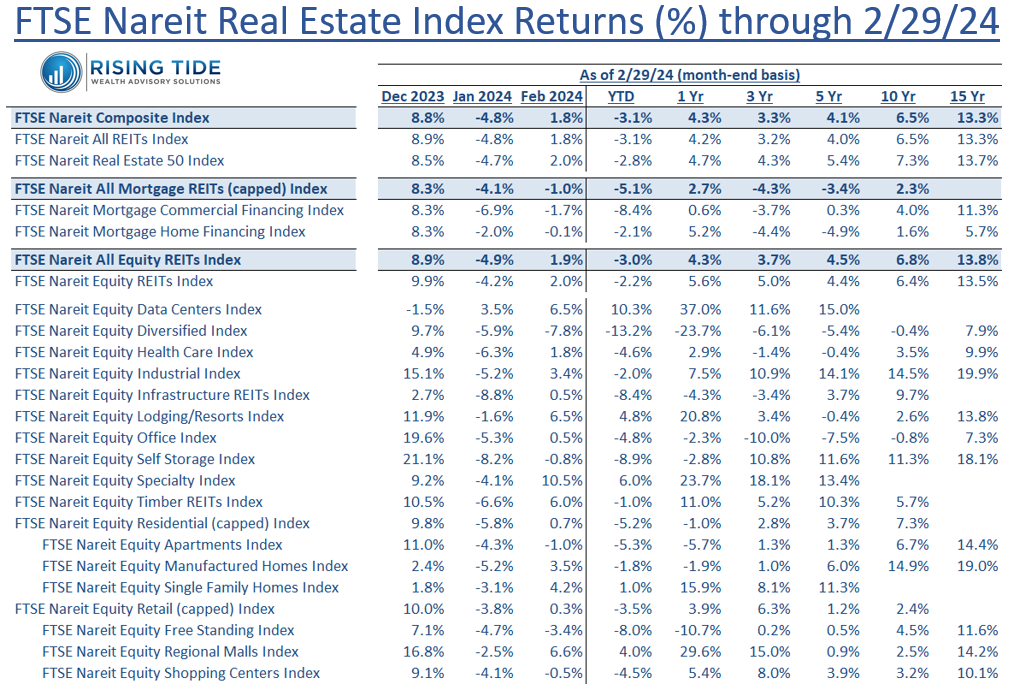

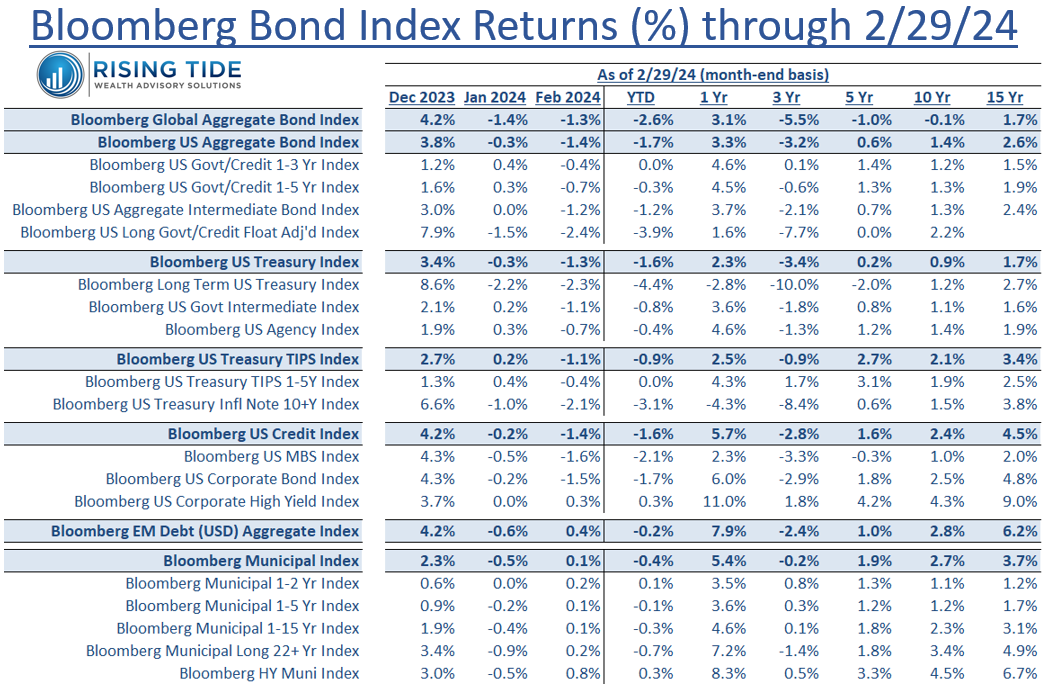

February marked another robust month for US stocks, with many of the trends observed in January persisting. Growth stocks maintained their outperformance over value stocks, while large caps outpaced small caps. Internationally, the US continued to lead, with Japan and Europe showing strong performance among developed markets, and China witnessing a reversal in its downturn within emerging markets. Real estate rebounded, halting its decline and moving upward. Bonds were lower nearly across the board as interest rates continued to move higher (the 10-year treasury yield rose from 3.99% at the end of January to 4.25% at the end of February), as hope for Fed rate reductions continue to get pushed further out into the year. See the tables below for more details on segment performance within the market.

Disclosures:

The tables above do not depict specific funds, but rather the index representation of certain asset classes. You cannot invest directly in an index. Returns above are total returns, which include interest/dividends. Past performance is not a guarantee of future results. The figures come from Morningstar Direct, a source believed to be reliable, but the accuracy of which cannot be guaranteed. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

Rising Tide Wealth Advisory Solutions, LLC (“RTWAS”) is a registered investment advisor offering advisory services in the State of Missouri and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Rising Tide Wealth Advisory Solutions, LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute RTWAS’s judgement as of the date of this communication and are subject to change without notice. RTWAS does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall RTWAS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if RTWAS or a RTWAS authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.