2025 Year-End Market Commentary (Short Version)

The Goldilocks Balancing Act

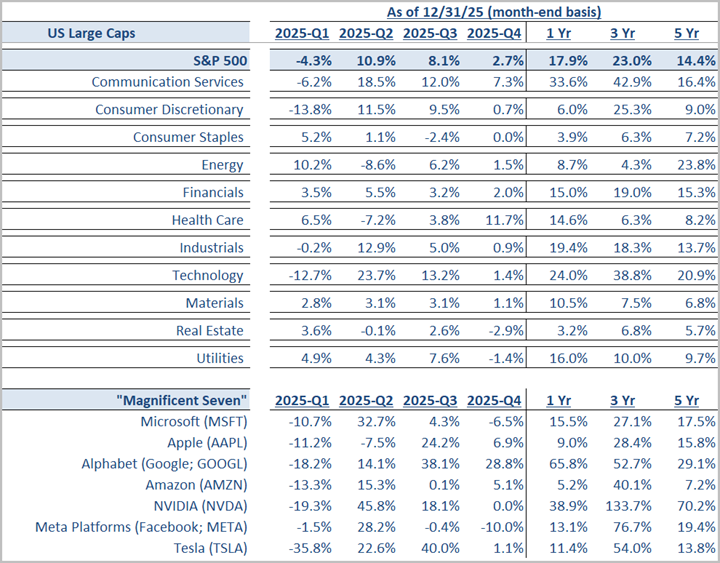

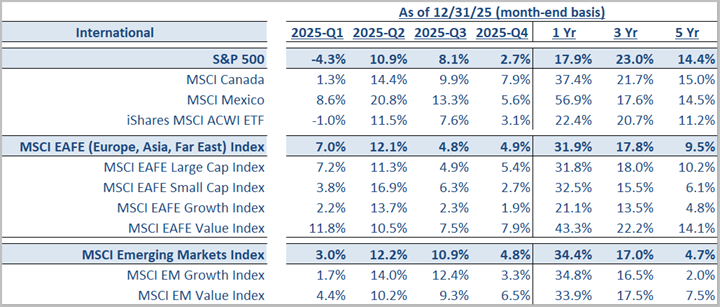

Global markets closed 2025 on a strong but increasingly balanced footing, with solid equity gains, improving bond performance, and broader leadership across regions and sectors. U.S. large caps delivered a strong year as the S&P 500 rose 17.9% including dividends, though Q4 marked a rotation away from mega-cap tech toward smaller-cap stocks, defensive growth, and higher-quality cyclicals. International equities outperformed the U.S., aided by firmer global growth and a weaker dollar, while bonds rallied as the Fed pivoted to rate cuts in the second half of the year. Within sectors, leadership shifted meaningfully, with Health Care and Communication Services leading gains, Technology cooling amid valuation-driven profit-taking, and Real Estate lagging under refinancing pressures and structural office challenges, all against a backdrop of resilient but moderating U.S. economic growth, easing inflation, and a gradually cooling labor market.

Asset Class Review

Strong Quarter Ends a Robust 2025 for Stocks

U.S. equities finished 2025 on a strong note, with solid Q4 gains capping a year supported by resilient growth, easing inflation, and fading recession fears. The S&P 500 rose 2.7% in Q4 and 17.9% for the year, ending near record highs as leadership broadened beyond mega-cap tech. Health Care and Communication Services led late-year gains, while Industrials and Financials benefited from steady activity and stable credit conditions, and rate-sensitive Real Estate lagged under high financing costs. Although mega-cap technology and AI leaders defined much of the year, their dominance eased in Q4 as valuations cooled, value stocks outperformed growth, and market breadth improved meaningfully, reflecting an economy that slowed but did not stall and setting a constructive backdrop entering the new year.

International equities posted outsized gains in 2025, decisively outperforming the U.S. after years of lagging as global growth stabilized, energy prices fell, and earnings recovered. Developed markets surged, led by Europe and Japan, where industrials and financials benefited from normalization and expanding margins, while emerging markets advanced on reform momentum, commodity strength, and a global tech upcycle, including a stimulus-driven rebound in China. Overall, 2025 underscored the value of global diversification, with non-U.S. equities breaking out and signaling a broader, healthier expansion beyond the U.S.

Fixed Income – Yields Fall and Bonds Rally as Fed Turns Dovish

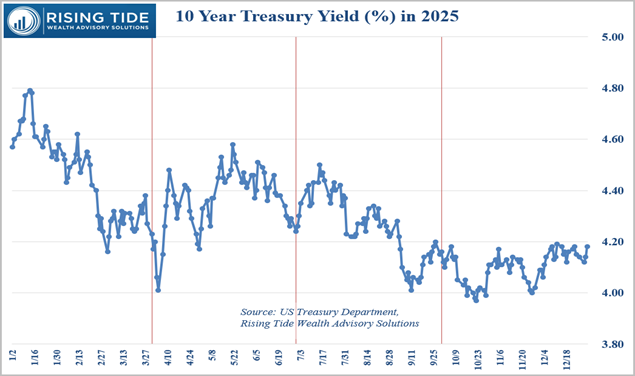

Bonds posted a solid Q4 and their best annual performance since 2020 as interest rates finally retreated from cycle highs. The Bloomberg U.S. Aggregate Bond Index increased 1.1% in Q4 and +7.3% in 2025, marking a sharp reversal after losses in 2021 and 2022, and restoring income and diversification benefits. Fed rate cuts in the second half of the year drove gains, with 2- and 10-year Treasury yields pulling back from post-2008 highs as policy expectations eased. Treasuries returned +0.9% in Q4 and +6.3% year-to-date, while long-duration bonds lagged due to residual yield volatility.

Crucially, credit markets remained stable. Credit markets stayed calm in 2025 as tight spreads and strong fundamentals balanced slower growth. Investment-grade corporates gained +0.8% in Q4 / +7.8% YTD, with spreads near multi-year lows, while high yield rose +1.3% in Q4 / +8.6% YTD, reflecting strong risk appetite and low defaults. Global bonds also performed well (+8.2% YTD unhedged; +4.9% hedged), boosted by a weaker dollar. Bottom line: 2025 was a bright spot for fixed income, with bonds again providing income and stability.

Alternative Assets & Real Estate – Gold Shines, Other Commodities Mixed, Crypto & REITs Fall

In 2025, alternative assets performance was mixed amid easing monetary policy and persistent geopolitical risks. Precious metals stood out as clear winners, with gold and silver surging on falling real rates and hedging demand, while broader commodities delivered modest, uneven gains as energy lagged. Cryptocurrencies drifted lower following late 2024 excesses, while private credit, private real estate, infrastructure, and real assets continued to attract capital, supported by higher yields and long-term secular themes. Public real estate lagged as range-bound interest rates and refinancing costs pressured REIT valuations. Private real estate values appeared to bottom, suggesting that additional rate relief in 2026 could improve the outlook despite recent underperformance.

U.S. Economic & Policy Update

The U.S. economy avoided recession in 2025, delivering a “Goldilocks” mix of steady growth and easing inflation. After roughly 2% growth in the first half, GDP reaccelerated to a 4.3% annualized pace in the third quarter, supported by resilient consumer spending, a narrower trade deficit, and strong tech and AI investment. Inflation continued to cool into late 2025, with headline inflation holding in the 2–3% range, core inflation falling to 2.6% and wage growth slowing to 3.5%. The labor market cooled meaningfully, with softer job gains, a modest rise in unemployment to 4.6%, and easing wage pressures, reducing inflation risks but still warranting monitoring. Against this backdrop, the Fed pivoted from restraint toward balance, delivering rate cuts in the second half of the year while emphasizing caution and data dependence. Fiscal tightening and tariff-related headwinds weighed on activity and sentiment but did not derail growth, as healthy household balance sheets, solid corporate cash flows, and supportive bank lending conditions helped absorb the drag.

As yields peaked and moved lower in 2025, financial conditions stabilized and markets adjusted to a lower-rate regime, with calm credit markets, broader equity leadership, and bonds once again providing income and diversification in an environment defined by slower but steadier growth rather than recession risk. The year rewarded balanced, diversified portfolios as equities benefited from earnings growth, while fixed income regained its stabilizing role. Looking ahead to 2026, the Fed has shifted to a data-dependent, wait-and-see stance with policy near neutral. Meanwhile, inflation continues to ease, earnings are growing, and rates appear to have peaked. Although risks remain from fiscal uncertainty, geopolitics, sticky inflation, or weaker global growth, the base case is a soft-landing scenario marked by moderating but ongoing growth, more balanced market leadership, and a relatively stable backdrop for both stocks and bonds, amounting to cautiously optimistic expectations after a strong 2025.