2025 Year-End Market Commentary

The Goldilocks Balancing Act

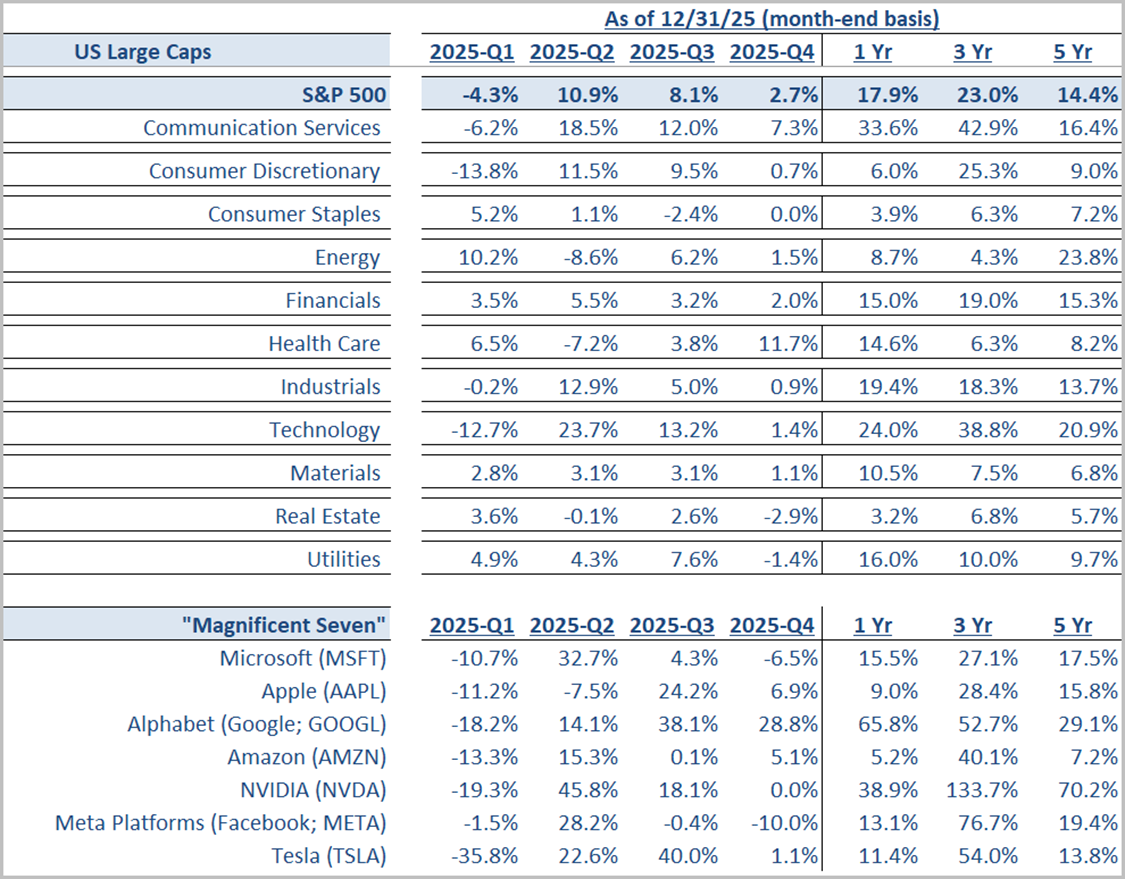

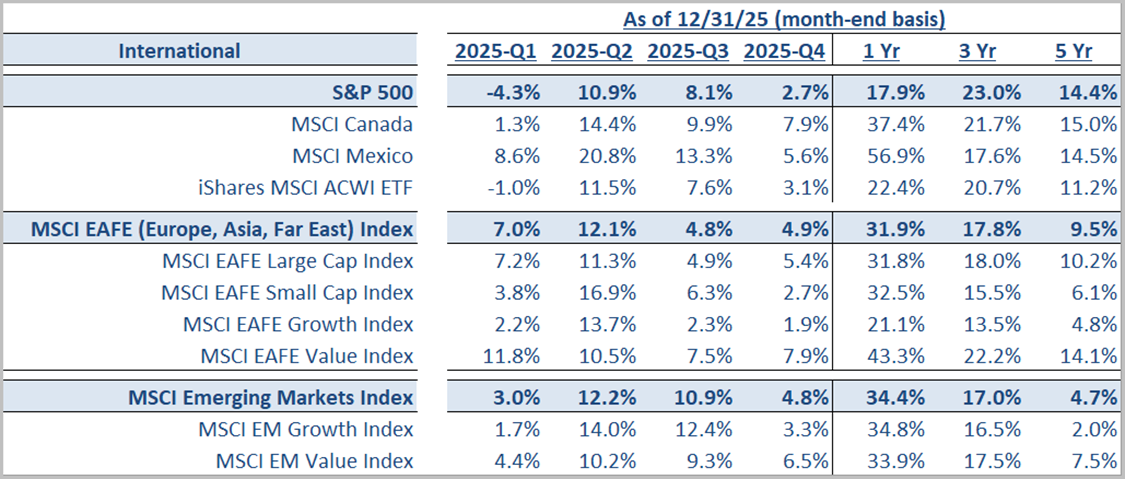

Global markets finished 2025 on a positive note. U.S. large-cap stocks extended gains in Q4, ending a strong year, while leadership among equities began to diversify beyond the mega-cap tech giants. The S&P 500 increased by +2.7% in Q4, bringing its year-to-date (YTD) total return to an impressive +17.9%, including dividends. A late-year rotation boosted previously underperforming sectors and smaller-cap stocks, as some of the “Magnificent Seven” mega-cap growth stocks took a breather. International markets outperformed the U.S. significantly in 2025, supported by improving global growth and a weakening U.S. dollar. Meanwhile, bond markets posted solid gains as the Federal Reserve shifted to interest rate cuts in the second half, easing pressure on yields. The U.S. economy remained resilient - GDP growth surprised to the upside in Q3 - but showed signs of moderation in Q4 amid cooling inflation and a gradually loosening labor market.

Sector leadership shifted decisively in Q4 as investors moved into defensive growth and high-quality cyclicals. Health Care stood out as the quarter's top performer, rising +11.7% (finishing +14.6% YTD). Communication Services remained strong (+7.3% in Q4, +33.6% YTD), supported by solid digital ad spending forecasted to grow 7.9% in 2025. In contrast, Real Estate lagged notably (-2.9% in Q4, +3.2% YTD), burdened by a $957 billion "maturity wall" of loan refinancing and record-high office vacancies, while Technology momentum slowed (+1.4% in Q4, +24.0% YTD) as valuation concerns led to profit-taking.

Full-Year 2025 Key Themes

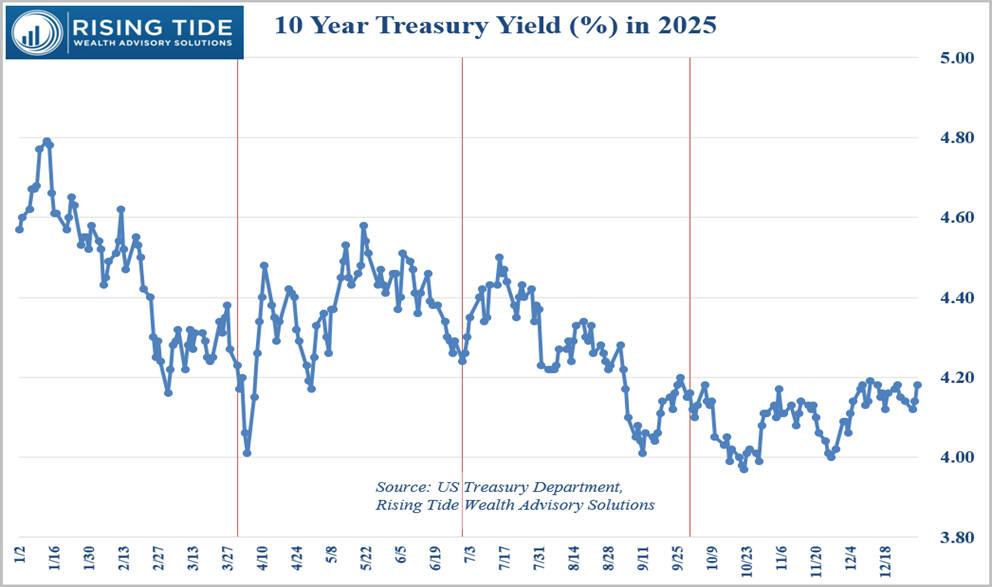

- Monetary Policy Pivot: After a volatile start, the Fed shifted from restriction to balance, cutting rates 75 bps in H2 as inflation eased. Treasury yields peaked at the beginning of the year and declined into Q4, supporting both bond and equity valuations while policymakers remained cautious.

- Broader Equity Leadership: Late-year market gains expanded beyond mega-cap tech into healthcare and value.

- Global Outperformance: Non-U.S. equities decisively outperformed on cheaper valuations, a softer dollar, and policy support.

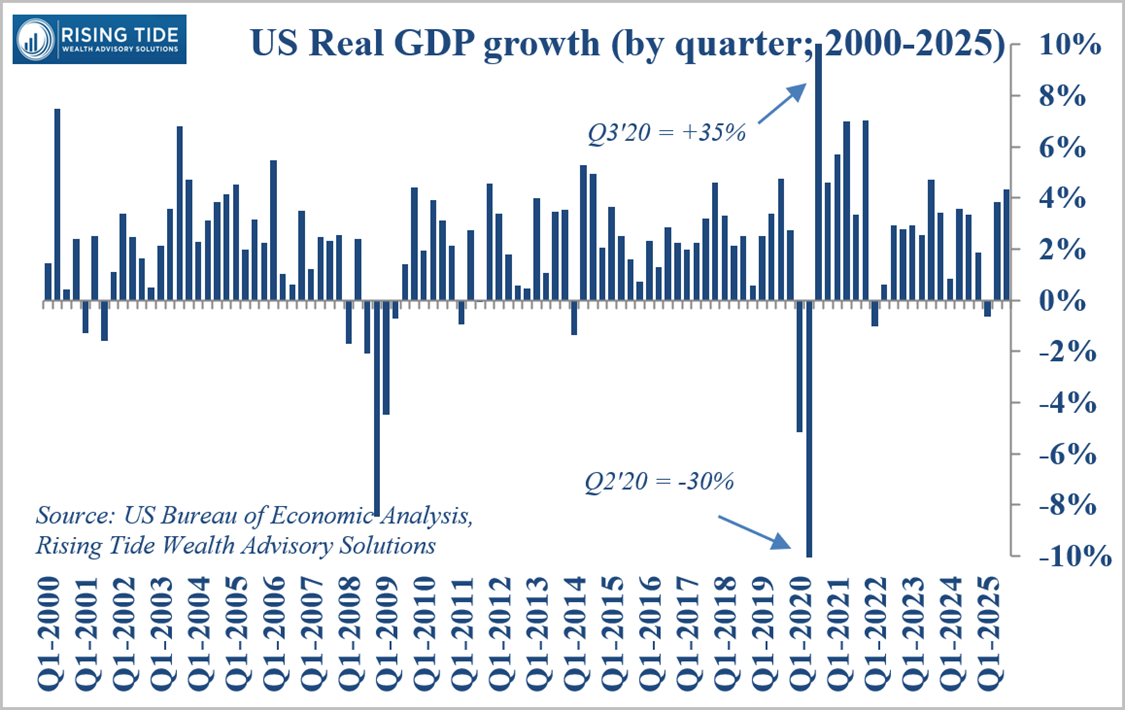

- Soft-Landing Growth: U.S. growth slowed but avoided recession, consistent with a controlled economic deceleration.

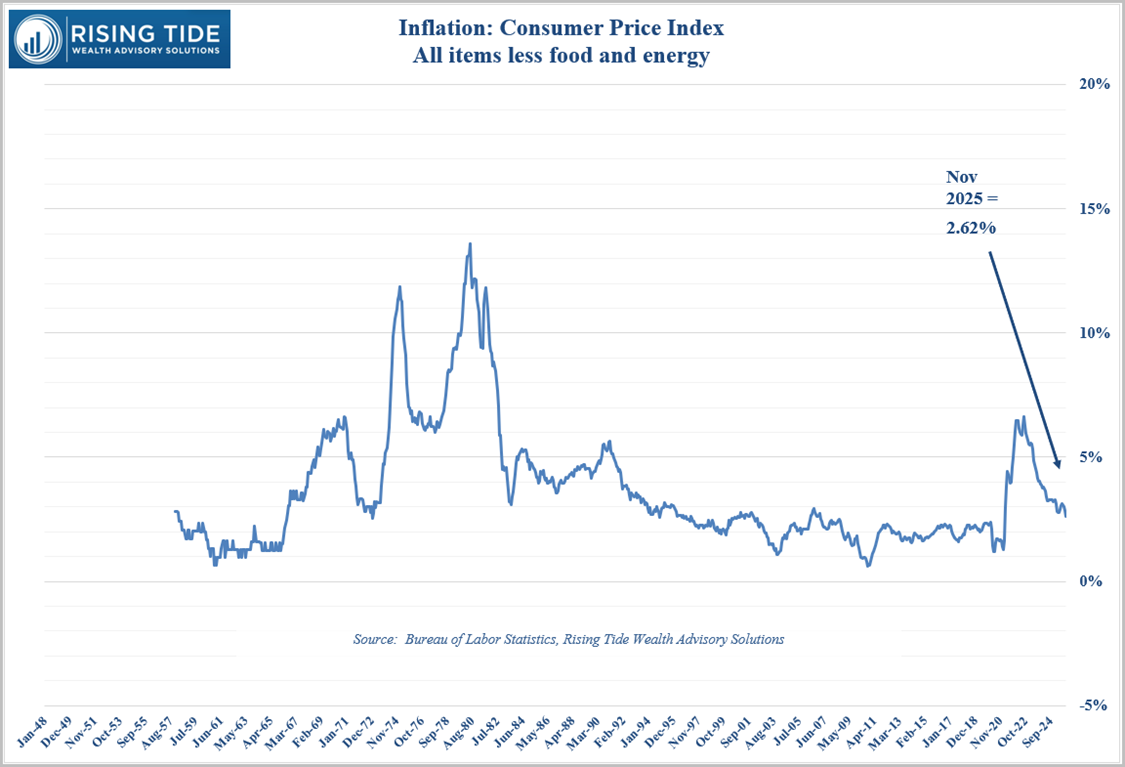

- Inflation Cooling: Inflation continued its downtrend from 2022 highs but remained above target.

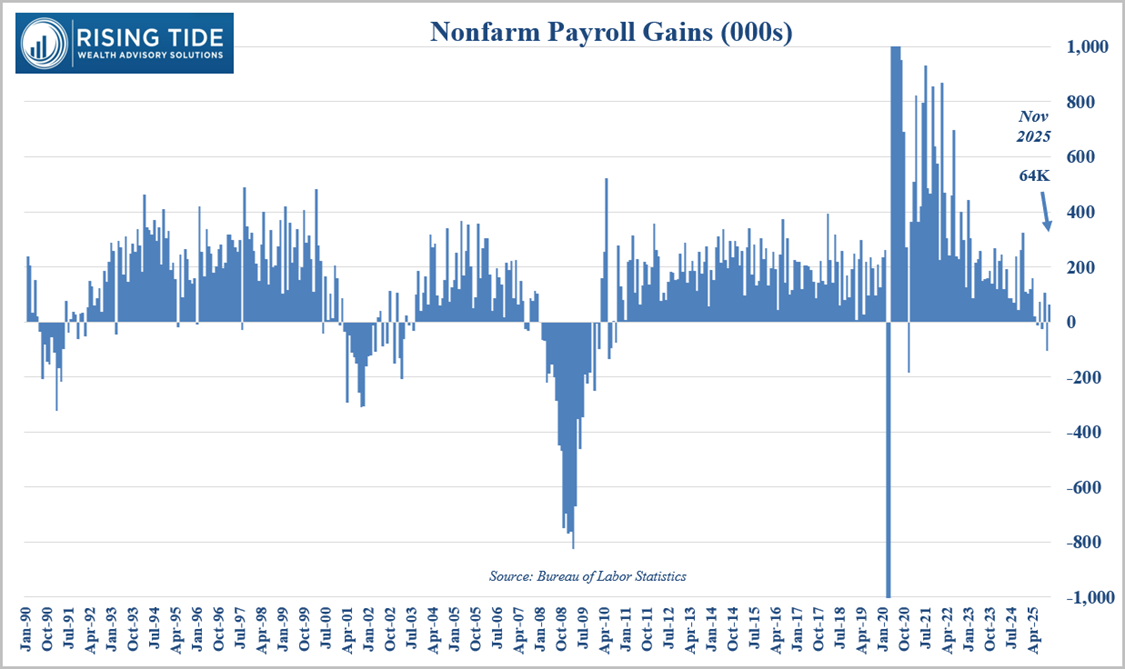

- Labor Normalization: Job growth and wages cooled, while the unemployment rate ticked higher.

- Bond Revival: Falling yields and tight credit restored fixed income as a reliable income and diversification tool.

- Alternative Resilience: Crypto fell, precious metals were extreme, other commodities were mixed, and private assets attracted flows for diversification.

Asset Class Review

Strong Quarter Ends a Robust 2025 for Stocks

U.S. equities posted solid Q4 gains, wrapping up a year supported by resilient growth, easing inflation, and moderating recession fears. The S&P 500 increased +2.7% in Q4 and +17.9% in 2025, ending near record highs. While early-year gains were primarily driven by mega-cap tech and AI leaders, Q4 saw a broader performance spread. Healthcare led (+11.7% Q4) on a rebound in pharma and biotech, while Communication Services gained +7.3% in Q4 (+33.6% YTD), reflecting strong earnings from internet and media platforms. Industrials and Financials also rose modestly, benefiting from steady activity and stable credit conditions. In contrast, rate-sensitive Real Estate declined -2.9% in Q4, as high financing costs continued to pressure valuations. Overall, equity performance in 2025 reflected an economy that slowed but did not stop, supporting risk assets as growth normalized and inflation eased.

Market leadership expanded significantly in late 2025 as the dominance of the “Magnificent Seven” eased. While mega-cap tech still largely defined the year, with Alphabet up +66% YTD and NVIDIA +39%, lifting the Nasdaq, Q4 saw a pause. Several leaders faltered (Microsoft and Meta declined in the quarter, while Nvidia’s rally stalled), reflecting a market reevaluating stretched valuations as the economy normalized. Value outperformed growth in Q4 (Russell 1000 Value +3.8% vs. Growth +1.1%), while small caps underperformed large caps (Russell 2000 +2.2% Q4), but micro-caps surged (+6.3% Q4). Overall, market breadth significantly improved in Q4, creating a positive environment heading into the new year.

International equities posted outsized gains in 2025, following years of underperformance, decisively outperforming the U.S. as growth stabilized, energy prices declined, and earnings recovered abroad. Developed markets soared (+31.9% YTD in USD; +4.9% Q4), led by Europe and Japan, as industrials and financials benefited from normalization and rising margins. Emerging markets also performed well (+34.4% YTD; +4.8% Q4), driven by reform optimism, commodity strength, and a global tech upcycle, most notably in semiconductors. China rebounded for the year on targeted stimulus despite late-Q4 volatility. The outcome: global diversification proved beneficial in 2025, with non-U.S. equities breaking out after years of lagging, highlighting a broader, healthier expansion beyond the U.S.

Fixed Income – Yields Fall and Bonds Rally as Fed Turns Dovish

Bonds posted a solid Q4 and their best annual performance since 2020 as interest rates finally retreated from cycle highs. The Bloomberg U.S. Aggregate Bond Index increased 1.1% in Q4 and +7.3% in 2025, marking a sharp reversal after losses in 2021 and 2022, and restoring income and diversification benefits. Fed rate cuts in the second half of the year drove gains, with 2- and 10-year Treasury yields pulling back from post-2008 highs as policy expectations eased. Treasuries returned +0.9% in Q4 and +6.3% year-to-date, while long-duration bonds lagged due to residual yield volatility.

Crucially, credit markets remained stable. Credit markets stayed calm in 2025 as tight spreads and strong fundamentals balanced slower growth. Investment-grade corporates gained +0.8% in Q4 / +7.8% YTD, with spreads near multi-year lows, while high yield rose +1.3% in Q4 / +8.6% YTD, reflecting strong risk appetite and low defaults. Global bonds also performed well (+8.2% YTD unhedged; +4.9% hedged), boosted by a weaker dollar. Bottom line: 2025 was a bright spot for fixed income, with bonds again providing income and stability.

Alternative Assets – Gold Shines, Commodities Mixed, Crypto Falls

In a year marked by central bank easing and intermittent geopolitical risk, safe-haven assets delivered strong returns. Gold soared to record highs, supported by falling real rates and strong hedging demand, ending +12.5% in Q4 and +64.4% YTD - one of 2025’s top performers. Silver lagged initially but surged in Q4, gaining +55.7% in the quarter and +148% YTD as speculative interest returned. The broader commodities market was mixed: energy prices experienced volatility but finished roughly flat, limiting gains. Overall, the S&P GSCI (Goldman Sachs Commodity Index) increased +1.0% in Q4 and +7.1% for 2025, with precious metals and agriculture offset by softer industrial metals and subdued crude, highlighting selective inflation hedging rather than a broad commodity boom.

Among other alternative investments, cryptocurrencies fell after the late-2024 surge. Bitcoin, which crossed $100,000 in 2024 traded mostly between $80k–$90k in 2025, ending the quarter down 23.5% and the year down 7.1%. Outside of crypto, private credit and private real estate continued to attract capital as higher yields supported income strategies, while infrastructure and real assets benefited from secular trends like the energy transition and supply-chain reshoring. Overall, alternatives strengthened their role in diversification amid moderating inflation, changing monetary policies, and ongoing geopolitical risks.

Real Estate & REITs – Under Pressure, Fundamentals Stabilize

REITs underperformed in 2025 as range-bound interest rates and refinancing costs pressured valuations. The FTSE Nareit All Equity REITs Index increased slightly for the year (+2.3% YTD) but dropped 2.1% in Q4 amid renewed rate volatility. However, underlying fundamentals proved more resilient than headlines suggest: high borrowing costs limited new construction, reducing future supply and supporting well-located assets. Occupancy and rental rates remained stable in sectors with long-term demand (such as housing, data centers, and industrial), often with inflation-linked lease escalators. Private real estate values stabilized after hitting bottom in late 2024, and declining mortgage rates have started to stabilize housing activity. Looking ahead, additional rate relief in 2026 could improve the environment for REITs, with limited new supply and steady demand promoting longer-term growth.

U.S. Economic & Policy Update

Growth accelerates, expansion intact:

The U.S. economy avoided a recession in 2025, offering a “Goldilocks” combination of steady growth and easing inflation. After about 2% growth in the first half of 2025, GDP reaccelerated to a 4.3% annualized rate in the third quarter, driven by strong consumer spending, a narrower trade deficit, and solid tech- and AI-led capital expenditures.

Inflation eases, but remains uneven:

Disinflation continued through late 2025. Inflation stayed within the 2–3% range, while core inflation decreased to 2.6%, down from 3.3% a year earlier. Shelter and services remained sticky, partly offset by falling energy prices, but slower growth in new leases suggests further housing disinflation. Goods inflation remained subdued outside tariff-affected categories. Average hourly earnings growth slowed to 3.5%, reinforcing a clear but incomplete path toward the Fed’s target.

Labor market cooling:

Employment conditions have eased significantly. Monthly job gains have remained below 150k in all but one month of 2025, and have even been negative for three of the last six months. Unemployment rose slightly to 4.6%. Quits dropped to post-2020 lows, and wage pressures eased, helping to alleviate inflation. The labor market situation still warrants close watching.

Monetary policy pivots from restraint to balance:

2025 marked a turning point in Fed policy. After maintaining restrictive settings early in the year, the Fed shifted toward easing as inflation trends improved and growth moderated. Rate cuts in the second half of the year reflected confidence that policy no longer needed to lean aggressively against the economy, while officials emphasized data dependence and caution around providing too much stimulus.

Fiscal and policy headwinds weigh, but do not derail growth:

Fiscal tightening and tariff effects acted as a drag on activity, creating pockets of uncertainty for businesses and consumers. These factors reduced growth expectations and occasionally increased volatility, but did not seem to impact underlying demand. Household balance sheets, corporate cash flows, and bank lending conditions remained supportive enough to absorb the policy headwinds.

Financial conditions stabilize; markets adjust to a lower-rate regime:

As yields peaked and declined, financial conditions became more favorable. Credit markets remained calm, equity leadership expanded, and fixed income assets regained their role as a portfolio stabilizer. Asset prices increasingly reflected an environment of slower but more consistent growth rather than recession risk.

Investment backdrop favors balance and diversification:

The full-year environment in 2025 rewarded diversified positions. Equities gained from earnings growth and broader market participation, while bonds offered income and protection against declines. Although growth slowed, the fundamentals remained strong, reinforcing the case for diversified risk-taking rather than being overly defensive.

Forward Outlook: As we turn to 2026, the main question is whether the positive trends from late-2025 can continue. The Fed has moved to a “wait-and-see” approach after its initial rate cuts, considering policy to be close to neutral and focusing on data dependence. If inflation keeps slowing and growth gradually softens, rates may remain steady or see one more cut in 2026. Still, recent strong growth suggests caution against over-stimulating the economy. Fiscal policy remains uncertain, with tariffs and tightening still affecting activity and political risks ongoing. Geopolitical tensions continue to cause volatility, boosting demand for safe havens like gold.

On the bright side, the outlook for markets entering 2026 is positive. Rates seem to have peaked, inflation is easing, and earnings are growing. Stock leadership has broadened, supporting a more stable economic expansion, while bonds once again offer attractive yields and diversification. Risks still exist - sticky inflation, limited Fed flexibility, or weaker growth overseas - but the main scenario is a moderating yet growing economy with balanced markets and steady earnings. After strong returns in 2025, expectations should be moderated, but a soft landing looks achievable, creating a potentially stable environment for both stocks and bonds in 2026.